rhode island property tax rates 2020

In 2020 the property tax rate for Exeter was 1557. DO NOT use to figure your Rhode Island tax.

Rhode Island Income Tax Ri State Tax Calculator Community Tax

The top rate for the Rhode Island estate tax is 16.

. 41 rows West Warwick taxes real property at four distinct rates. The countys average effective property tax rate is. If you live in Rhode Island and are thinking about estate planning this.

Monday - Thursday 830 am - 530 pm. Personal Property Information and Forms. Rhode Islands largest county by area and by population Providence County has the highest effective property tax rates in the state.

That number has fallen considerably to 1372. Rhode Island Property Tax Rates for 2020 tax rate per thousand dollars of assessed value Click table headers to sort Tax Rates Markers. The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000.

FY 2019 Property Tax Cap. Central Falls has a property tax rate of. Instead if your taxable income.

The current tax rates and exemptions for real estate motor vehicle and tangible property. Westerly Town Hall 45 Broad Street Westerly RI 02891 Phone. Pensions Benefits Toggle child menu.

Recent Tax Rate History - Tax Rates from 1893 - 1996. Property Tax Cap. Its a significant drop and one that could worth taking advantage of.

Initial Application for Senior or Disabled Tax Credit. 15 15 to 20 20 Click tap or touch markers on the. FY 2021 Property Tax Cap.

Counties in Rhode Island collect an average of 135 of a propertys assesed fair market value as property tax per year. Pensions Benefits Toggle child menu. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income.

2989 - two to. Tax Rates for the 2022-2023 Tax Year. Tax amount varies by county.

Providence has a property tax rate of 2456. FY2023 Tax Rates for Warwick Rhode Island FY2023 starts July 1 2022 and ends June 30 2023 There was no increase in our tax rates from last year the tax rates remain. 1463 for Real Estate and Tangible Property.

Property Tax Cap. It kicks in for estates worth more than 1648611. FY 2020 Property Tax Cap.

Rhode Island Towns with the Highest Property Tax Rates. 135 of home value. West Greenwich has a property tax rate of 2403.

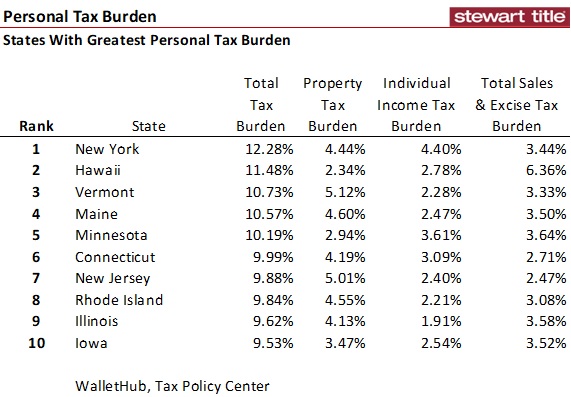

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

Golocalprov New Ri Dlt Announces Unemployment Insurance Tax Rates For 2022

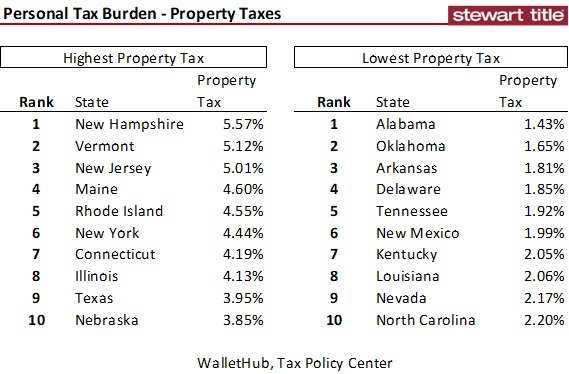

These States Have The Highest Property Tax Rates Thestreet

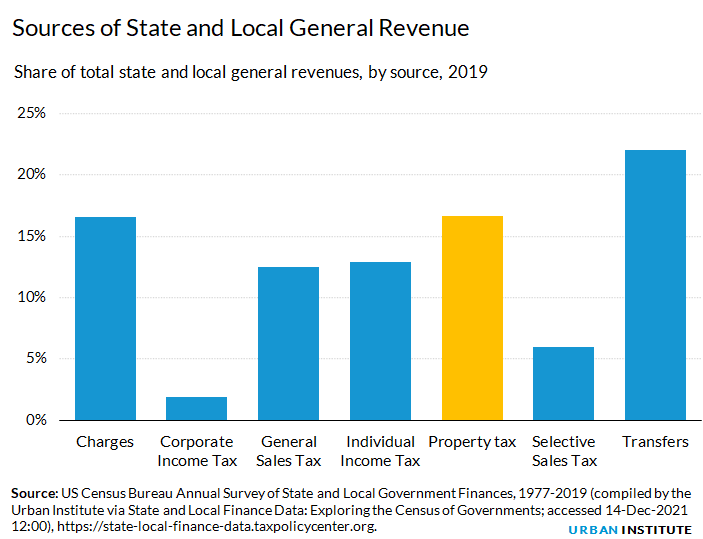

Property Taxes Urban Institute

Rhode Island S Funding Formula After Ten Years Education Finance In The Ocean State Rhode Island Public Expenditure Council

No Boat Taxes In Rhode Island Yes It S True Hogan Associates Real Estate Blog

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

Payments For Local Tax Exempt Properties Reconsidered The Brown Daily Herald

Property Taxes High In Ohio And Dayton L Dayton Business

State Sales Tax Rates Sales Tax Institute

17 States With Estate Taxes Or Inheritance Taxes

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Property Tax Calculator Estimator For Real Estate And Homes

Property Taxes By State 2017 Eye On Housing

Wyoming 2022 Sales Tax Calculator Rate Lookup Tool Avalara

How Do State And Local Sales Taxes Work Tax Policy Center

Map Of Rhode Island Property Tax Rates For All Towns

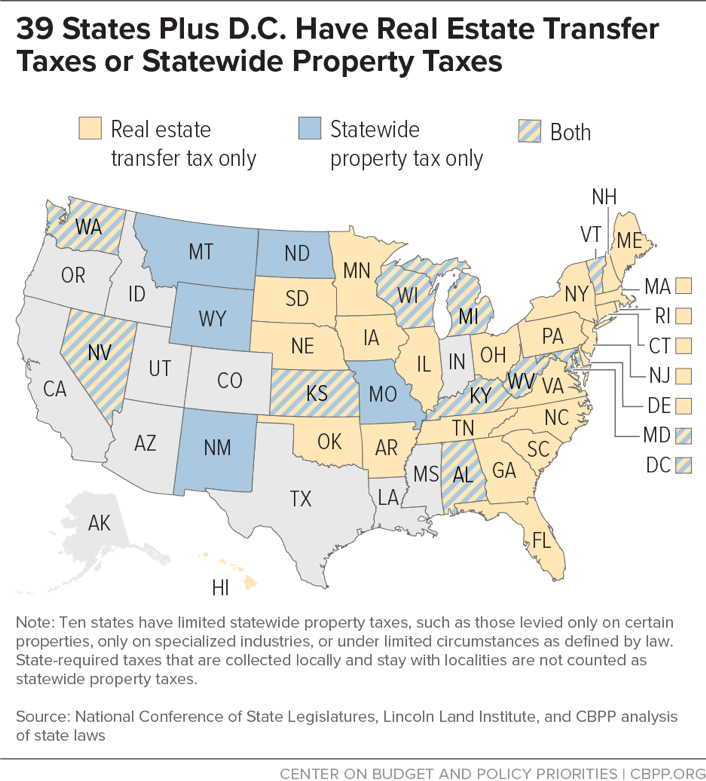

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities